On the occasion of the 75th anniversary of the end of World War II, the Prime Minister of Great Britain writes about Polish pilots serving in the Royal Air Force and the role of Poles in other battlefields, as well as about a long Polish-British friendship. You will find the entire article by Boris Johnson below.

"Perhaps more than anywhere else in Britain, my London constituency of Uxbridge and South Ruislip is a living symbol of friendship with Poland.

I could show you the flags of our two countries, flying side-by-side over the memorial to Polish pilots who served in the Royal Air Force during the Second World War.

Then I could take you across the road to the RAF base at Northolt, once the home of Polish aircrew, now a hub for official travel. I often depart from the same runway where Polish pilots took off to confront the Nazis. I follow in the slipstream of the Poles of 303 Squadron, who flew Hurricanes from Northolt in the summer of 1940. They shot down more enemy aircraft during the Battle of Britain than any other squadron in the RAF.

Today we celebrate the 75th anniversary of the defeat of Nazi Germany. This is a moment to emphasise the strength of the friendship between Britain and Poland, forged in our shared struggle against tyranny. This should also be a time for friends of Poland to reflect on her ordeal during the Second World War.

In 1939, Poland was invaded first by Nazi Germany and then by the Soviet Union. She was attacked from the west and the east, trapped between the hammer of communism and the anvil of fascism.

Yet Poland’s national spirit proved indomitable. At home, the Polish resistance carried on the struggle against overwhelming odds. Elsewhere, Polish forces served alongside the Allies in almost every significant battle, from Monte Cassino to El Alamein, from Arnhem to Tobruk.

When victory came 75 years ago, Poland’s experience was different from elsewhere in Europe. The shadow of tyranny did not disappear. Poland had to wait another 44 years before regaining her freedom and national independence in 1989.

Through all these struggles, Britain and Poland stood together. Today, we rejoice that after the tragedies of the 20th Century, after the determined efforts to wipe her from the map, Poland is a thriving nation in the heart of Europe.

Britain is proud to work alongside Poland in every field. We are NATO allies; our armed forces cooperate ever more closely. As I write, British soldiers are serving on Polish soil, helping to guarantee our shared security.

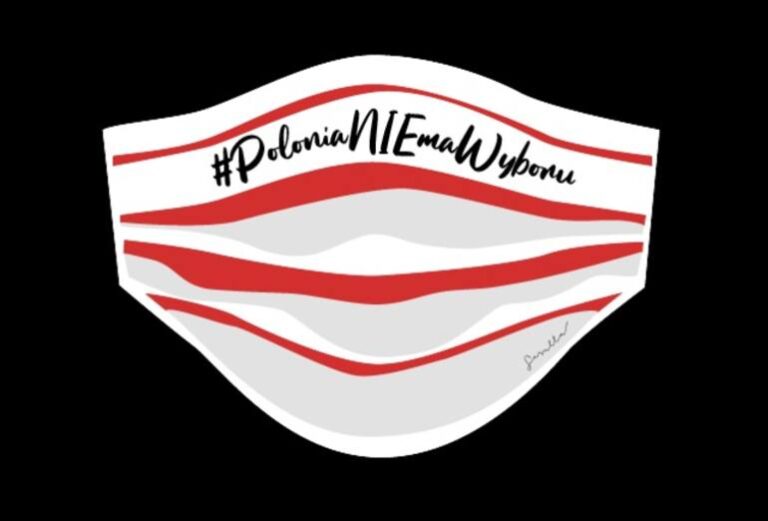

But the greatest manifestation of our friendship is the presence of one million Poles in the UK, many of whom live in my constituency. I cannot list all of their manifold contributions to our national life. Far better for me to say: they are valued, they are cherished and they are loved. In fact, we can hardly imagine the UK without them.

Britain and Poland fought for the same ideals and we stand for the same values. Whenever I see our flags flying in my constituency, I reflect on everything we have achieved together – and everything we can yet do".